When to sell?

What is the organizations Enterprise Value?

What is the multiple 5X or 30X ?

How can the Value be increased?

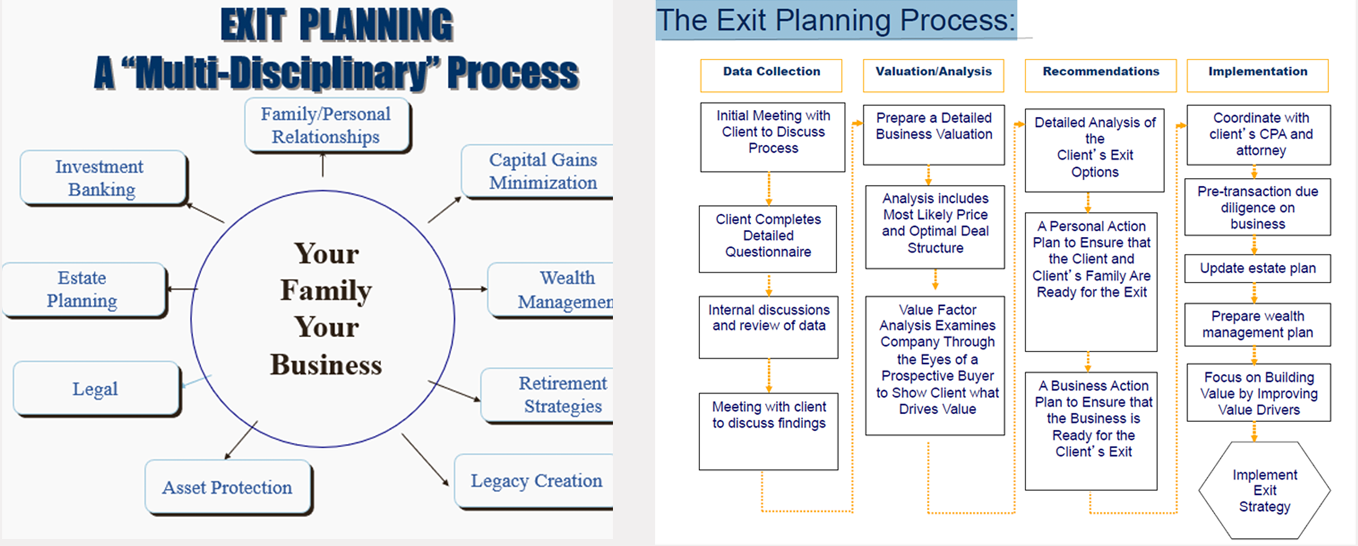

Exit and Succession Planning is a strategic process undertaken by business owners to prepare for the eventual transition of their ownership and leadership roles in a company. This planning is crucial for ensuring a smooth and orderly transition, whether it involves selling the business, passing it on to family members, or transitioning to a new management team.

Key elements involved in exit and succession planning include:

1. Identification of Objectives: The first step is to determine the owner's goals and objectives for the transition. This could include financial targets, legacy considerations, and timing preferences.

2. Valuation of the Business: An accurate assessment of the business's value is essential to determine a fair asking price or to allocate shares if transferring to family members or other stakeholders.

3. Legal and Financial Due Diligence: Ensuring that the business's financial records are accurate, up-to-date, and in compliance with all relevant laws and regulations is critical for attracting potential buyers or successors.

4. Selection of Successors: This involves identifying and preparing potential successors, whether they are family members, key employees, or external buyers. This may involve training and mentoring.

5. Tax Planning: Assessing the tax implications of the transition and implementing strategies to minimize tax liabilities for both the seller and the buyer or successor.

6. Financial and Retirement Planning for the Owner: Planning for the owner's financial future post-transition, including retirement funding and wealth management.

7. Transition Timeline: Establishing a clear timeline and milestones for the transition process, including key dates for handing over responsibilities and ownership.

8. Contingency Planning: Preparing for unexpected events that could impact the transition, such as illness, disability, or other unforeseen circumstances.

9. Communication and Stakeholder Management: Effectively communicating the transition plan to employees, customers, suppliers, and other stakeholders to ensure a smooth transition and maintain trust.

10. Documentation and Legal Agreements: Drafting and reviewing legal documents, such as sale agreements, buy-sell agreements, and any contracts related to the transition.

11. Post-Transition Monitoring: Implementing a system to monitor and evaluate the progress of the transition, and making adjustments as needed.

Exit and succession planning is a critical aspect of ensuring the long-term success and continuity of a business. It requires careful consideration of both financial and non-financial factors, as well as a well-defined strategy to address the unique circumstances of the business owner and the company itself.